In this blog, we’ll explore the significance of the CrossFi Mainnet.

The upcoming launch of the CrossFi Mainnet on October 15, 2024, marks a significant milestone in the world of blockchain technology and DeFi. This launch will unlock the full potential of CrossFi’s Layer 1 blockchain, a powerful, scalable platform designed to bridge the gap between traditional finance and the rapidly evolving decentralized financial ecosystem.

In this blog, we’ll explore the significance of the CrossFi Mainnet, the critical stages of blockchain development, and the vital role the XFI token plays in powering the CrossFi blockchain. We’ll also highlight the importance of CrossFi’s integration with the Ethereum Virtual Machine (EVM) and how this dual-chain structure strengthens its ecosystem.

Critical Stages in Blockchain Development

Blockchain projects typically go through two significant stages before reaching operational maturity: the testnet and the mainnet. Understanding these phases is crucial for developers and users as they offer unique environments for experimentation, testing, and real-world deployment.

Testnet: A Sandbox for Experimentation

The testnet is an early-stage, experimental blockchain version designed for testing and development. It is a sandbox environment where developers can experiment with smart contracts, dApps, and other blockchain solutions without risking losing real assets.

The key characteristics of a testnet include the absence of real-world value for its tokens, which allows developers and users to interact with the network without financial risk freely. This environment facilitates debugging and optimization, enabling developers to verify smart contracts and decentralized applications by refining code before deploying it on the mainnet. Additionally, testnets offer low-risk user engagement, where users can explore the system’s features and functionalities using test tokens distributed via faucet systems, gaining familiarity with the platform before investing real assets. The CrossFi testnet has exemplified these qualities, serving as a robust environment for both developers and users, fostering innovation and ensuring that decentralized applications are fully prepared ahead of the mainnet launch.

Unique Features of CrossFi Testnet

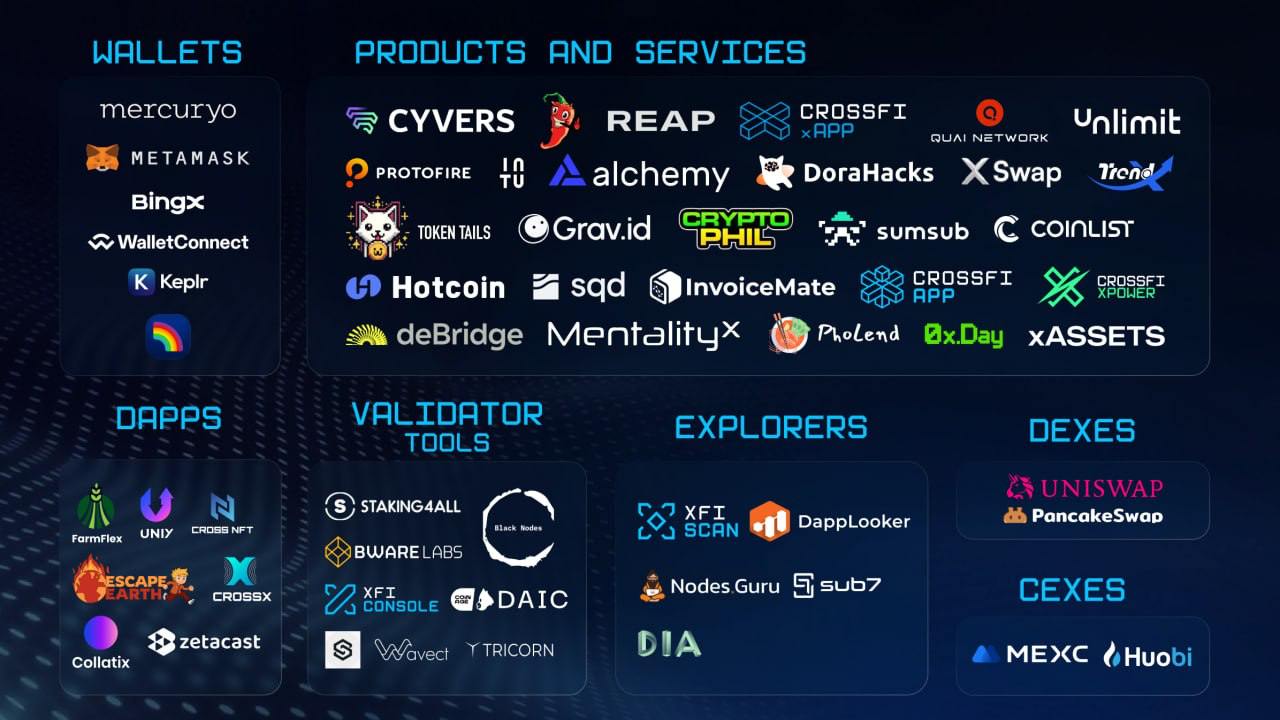

On February 20th, 2024, CrossFi successfully launched its EVM Testnet on Coinlist. In seven months, we have reached a million users and more than 19 million transactions on the testnet. The CrossFi Testnet stands out due to the high level of international developer and user support it has received since its launch. Key features include:

- Extensive dApp Testing: Developers from across the globe have utilized the CrossFi testnet to test their decentralized applications, building a robust foundation ahead of the mainnet launch.

- User Interaction: The testnet has enabled users to interact with decentralized applications and provide valuable feedback, ensuring a smooth transition to the mainnet.

- Seamless Migration: All the applications tested on the CrossFi testnet are ready to go live on the mainnet, offering users a range of services from day one.

Mainnet: The Live Blockchain Ecosystem

The mainnet represents the fully operational version of the blockchain, where real assets are used, and all activities have tangible financial implications. Unlike the testnet, primarily for testing, the mainnet is where real-world economic activity occurs.

Key features of a mainnet include:

- Real-World Transactions: Every mainnet transaction involves real tokens with market value. These tokens can be traded on exchanges, used as collateral in DeFi protocols, or spent on network services.

- Transaction Fees (Gas): Every interaction with the blockchain, such as sending tokens or deploying smart contracts, incurs transaction fees paid in the native currency (e.g., XFI on CrossFi native coin that has real value). These gas fees incentivize validators to process and verify transactions, ensuring the network’s security.

- Immutable and Transparent Ledger: Transactions on the mainnet are recorded permanently on the blockchain, ensuring traceability, security, and trust.

- Full dApp Integration: Decentralized applications, including DeFi protocols, DEXs, and more, run on the mainnet for end-users.

- Economic Incentives: Validators and network participants are rewarded with the native token for their role in securing the network and providing essential services such as transaction processing and liquidity provision.

The CrossFi Ecosystem

The CrossFi ecosystem is a comprehensive suite of platforms and services designed to bridge traditional finance with DeFi, offering users and developers a seamless and efficient financial experience. Below is an in-depth look at each component of the ecosystem:

CrossFi Chain: CrossFi Chain is a Layer 1 blockchain engineered for unlimited scalability and exceptional transaction speeds. It empowers developers and users by providing a seamless, high-performance platform that facilitates the creation of interoperable financial products. CrossFi Chain lays the groundwork for a borderless financial future by supporting over-collateralized stablecoins and synthetic asset minting. Its scalable infrastructure ensures the network can handle many transactions efficiently, making it ideal for applications requiring speed and reliability.

CrossFi APP: The CrossFi APP is a unified financial application that merges Web3 technology with traditional finance. It features staking, lending, peer-to-peer payments, crypto-to-fiat exchange, and virtual debit cards, offering users a seamless experience managing crypto and fiat assets. The app aims to democratize access to financial services by integrating decentralized technology with familiar tools, providing a user-friendly interface that bridges the gap between conventional banking and the digital asset world.

CrossFi xAPP: CrossFi xAPP is a decentralized finance (DeFi) platform that enables users to engage in token swaps, bridge assets across various chains, earn/get CrossFi’s native currency XFI as rewards for staking, emit the algorithmic stablecoin XUSD using an over-collateralization mechanism, and participate in liquidity provision. Beyond these functionalities, the xAPP offers a robust staking program on the CrossFi Chain, allowing users to earn rewards while contributing to the ecosystem’s efficiency. It serves as a comprehensive hub for DeFi activities within the CrossFi network, enhancing user engagement and ecosystem growth.

CrossFi Foundation: The CrossFi Foundation is a non-profit organization that fosters ecosystem growth through grants, hackathon funding, and educational resources. It is crucial to ensure decentralized governance and community empowerment by supporting users, ambassadors, developers, and validators through global initiatives and incentives. The Foundation’s efforts aim to cultivate a vibrant community that actively participates in shaping the future of the CrossFi ecosystem.

XAssets: XAssets is a decentralized platform for minting, trading, and swapping real-world assets as synthetic tokens. An overcollateralized pool of other tokens fully backs these synthetic tokens, ensuring the system’s security and stability. The platform enables users to access advanced financial products like margin trading and options trading. An integrated oracle system continuously monitors positions and asset prices to support trading products, allowing for effective management and real-time adjustments. Overcollateralization minimizes the risk of underfunding, keeping XAssets robust and secure.

XStake: XStake is an omnichain meta-yield aggregator designed to maximize capital efficiency for users’ staked assets. It offers the highest returns through vaults that employ strategies across multiple networks, leveraging lending and staking protocols to optimize yields. The platform’s oracle system continuously monitors incentives and prices, automatically rebalancing users’ positions across chains and protocols. This seamless, autonomous rebalancing eliminates the need for active management, making XStake a hands-free and efficient solution for maximizing returns in the DeFi landscape.

The Significance of CrossFi Mainnet Launch

The launch of the CrossFi Mainnet is significant for several reasons:

Real Asset Interaction: With the launch of the CrossFi Mainnet, users will be able to interact with real assets in a secure and decentralized environment. Every transaction involving staking, liquidity provision, or interacting with DeFi protocols will be tied to real tokens with tangible market value.

Comprehensive Ecosystem Ready at Launch: One of CrossFi Mainnet’s key strengths is the comprehensive ecosystem of applications available from day one. These include decentralized applications for staking, liquidity mining, and asset trading, giving users the opportunity to immediately engage with financial operations and earn returns on their XFI tokens.

Enhanced Security and Stability: The CrossFi Mainnet has undergone rigorous testing and security audits, ensuring the platform is secure and stable. This is particularly important as the mainnet will handle high-value transactions and large-scale user participation, making security paramount for long-term growth and adoption.

Interoperability and Growth Potential: By integrating EVM alongside Cosmos, CrossFi’s dual-chain structure allows for interoperability between blockchains. This enhances the platform’s flexibility and future-proofing, making CrossFi a competitive player in the decentralized finance space.

Benefits of EVM Integration

EVM (Ethereum Virtual Machine) is a software platform that enables the execution of smart contracts and decentralized applications. By integrating EVM into the CrossFi Mainnet, CrossFi significantly expands its capabilities, opening up new opportunities for users, developers, and investors.

- Advanced DeFi Tools: EVM integration allows the creation of complex decentralized financial products such as decentralized exchanges (DEXs), automated market makers (AMMs), and yield farming strategies. These tools, widely used in EVM-compatible networks like Ethereum, provide higher potential investment returns.

- Broader Investment Strategies: The integration of EVM enables CrossFi to cater to retail and institutional investors, increasing the network’s capital efficiency.

- Interoperability Between Cosmos and EVM: The dual-chain structure of CrossFi, combining Cosmos’ scalability with EVM’s programmability, attracts a diverse range of developers and users, fostering a thriving ecosystem.

- Developer Adoption: By supporting EVM, CrossFi becomes attractive to Ethereum developers who can easily port their applications, helping to grow the CrossFi ecosystem.

The Role of XFI Coin in the CrossFi Blockchain

XFI is the native cryptocurrency of the CrossFi Chain. The CrossFi ecosystem aims to provide scalable, secure, and interoperable solutions that enhance financial inclusivity and accessibility. Below is a comprehensive overview of XFI and its role within the CrossFi ecosystem.

What is XFI?

- Native Coin: XFI serves as the fundamental currency of the CrossFi Chain, facilitating transactions, staking, governance, and other network activities.

- Utility Token: It pays transaction fees, incentivizes network validators, and participates in the platform’s governance mechanisms.

- Collateral Asset: XFI can be used as collateral to mint xUSD, CrossFi’s algorithmic stablecoin.

Emission Model

The Cross Finance team aims to enhance the value and demand for the XFI token by strategically managing its supply and leveraging its utility features. The emission model focuses on the following key strategies:

- Limited Total Supply of XFI: The total number of XFI tokens is capped, inherently restricting the overall supply and creating scarcity.

- Decreasing Emission Rate: Over time, the rate at which new XFI tokens are emitted will decrease, further limiting the influx of new tokens into the market.

- Impact of New MPX Holders: Each new MPX holder increases demand for XFI while constricting its available supply, contributing to potential value appreciation.

- Token Burn via Transaction Fees: In the EVM (Ethereum Virtual Machine) segment of the CrossFi Chain, XFI tokens used to pay transaction fees will be burned. This process reduces the total circulating supply of XFI by permanently removing tokens from circulation.

By gradually increasing demand and decreasing supply through these mechanisms, the emission model is designed to create scarcity, which may drive up the token’s value over time. This approach reflects a thoughtful strategy aimed at enhancing the long-term viability and value of the XFI token.

Key Features of XFI

Transaction Fees

- Network Operations: XFI is used to pay for transaction fees on the CrossFi Chain, ensuring smooth and efficient network operations.

- Cost-Effective: The use of XFI for fees helps reduce costs compared to traditional financial transactions.

Staking and Rewards

- Network Security: Users can stake XFI to become validators or delegate their tokens to validators, contributing to the network’s security and consensus mechanism.

- Earn Rewards: Stakers receive rewards in XFI for their participation, incentivizing active involvement in maintaining the network.

Governance Participation

- Decision-Making Power: XFI holders have the right to participate in governance by voting on proposals that affect the future of the CrossFi ecosystem.

- Proposal Submission: Users can submit proposals for network upgrades, parameter changes, and other critical decisions, fostering a decentralized governance model.

Collateralization for xUSD

- Minting xUSD: XFI is used as collateral to mint xUSD, and CrossFi’s stablecoin is pegged to the US dollar.

- Collateral Ratio: Users must maintain a minimum collateralization ratio of 300%, locking $300 worth of XFI to mint 100 xUSD.

- Asset Retention: This mechanism allows users to leverage their XFI holdings without selling them, preserving potential asset appreciation.

Interoperability

- Cross-Chain Compatibility: XFI facilitates interoperability with other blockchain networks, allowing seamless transfer of assets and data across different platforms.

- DeFi Integration: It enables integration with various DeFi protocols and applications within and beyond the CrossFi ecosystem.

Security and Trust

Security and trust are fundamental to the CrossFi Chain’s operations, achieved through a robust consensus mechanism and unwavering transparency. By utilizing a Proof-of-Stake (PoS) model or a variant thereof, CrossFi enhances both security and energy efficiency. This mechanism incentivizes validators to act honestly, as they have a stake in the network’s success, thereby securing it against malicious activities. CrossFi conducts regular audits on its smart contracts to further ensure the platform’s integrity and identify and rectify any vulnerabilities. These audits are performed internally and involve reputable third-party security firms for independent assessments, adding an extra layer of verification.

Transparency is another cornerstone of CrossFi’s approach. All transactions and smart contract activities involving XFI are fully transparent and verifiable on the blockchain, allowing users to trace and confirm activities as needed. The CrossFi team is committed to keeping the community informed through regular updates and fostering an environment of open communication and trust. This combination of advanced security measures and transparent practices ensures that users can engage with the CrossFi ecosystem with confidence.

Benefits of Using XFI

Using XFI brings many benefits that promote financial inclusivity, economic opportunities, and personal control over assets. Firstly, XFI grants users access to decentralized financial services without the traditional barriers imposed by centralized institutions. This means anyone with an internet connection can participate in the CrossFi ecosystem, ensuring global accessibility and allowing people from all walks of life to engage with DeFi platforms.

Economically, XFI offers significant earning potential. Users can stake their tokens and participate in various network activities to earn rewards, providing a passive income stream. Additionally, as the CrossFi ecosystem expands and gains more adoption, the value of XFI could appreciate, contributing to wealth growth for token holders.

In terms of control and ownership, XFI embodies the principles of decentralization. Users maintain complete control over their assets within Metamask without relying on central authorities, reducing the risks associated with centralized control, such as censorship or asset freezing. The platform’s open-source code and transparent operations further build trust within the community, as users can verify the network’s integrity and stay informed about developments. This combination of inclusivity, economic opportunity, and autonomy makes XFI a compelling choice for individuals seeking to participate in the future of decentralized finance.

How to Obtain XFI

There are several ways to obtain XFI tokens, each offering different opportunities based on your preferences and technical expertise. One of the most straightforward methods is purchasing XFI on cryptocurrency exchanges. XFI is listed on supported platforms such as MEXC and HTC for USDT or swap at Uniswap and Pancakeswap. These exchanges allow you to acquire XFI using various trading pairs, including popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), or stablecoins. This accessibility makes it convenient for users to invest in XFI using assets they already hold.

Another avenue to obtain XFI is through staking rewards. By staking your MPX or XFI holdings, you contribute to the network’s security and, in return, earn additional XFI tokens as rewards. This not only helps maintain the integrity of the CrossFi blockchain but also provides a passive income stream for participants. For those with the necessary technical skills and resources, setting up a validator node offers the potential for even higher rewards. Running a validator node involves validating transactions and blocks on the network, and validators are compensated with XFI tokens for their essential services.

Lastly, CrossFi periodically offers incentive programs where users can earn XFI through participation in promotional events. These programs may include airdrops, where XFI tokens are distributed to users for free or in exchange for completing specific tasks or meeting certain criteria. Engaging in these promotions is an excellent way to increase your XFI holdings while becoming more involved with the CrossFi community. Whether through direct purchase, staking, or participating in incentive programs, acquiring XFI provides various benefits and entry points into the CrossFi ecosystem.

Uses of XFI in the CrossFi Ecosystem

DeFi Applications

- Staking in xApp: XFI holders can actively participate in securing the CrossFi network by staking their tokens through the xApp platform. By staking XFI, users delegate their tokens to validators who process transactions and maintain the blockchain’s integrity. In return for their contribution, stakers earn incentives such as additional XFI tokens or a percentage of transaction fees. This provides a passive income stream and strengthens the network’s security and efficiency. Staking through xApp is user-friendly, allowing even those new to DeFi to participate easily.

- Liquidity Provision in xSwap: The xSwap platform is CrossFi’s native decentralized exchange (DEX), where users can trade various cryptocurrencies. By providing liquidity using XFI, users deposit their tokens into liquidity pools that facilitate trading on the platform. In exchange for supplying liquidity, participants earn fees generated from trades within the pool and receive Liquidity Provider (LP) tokens representing their share. These LP tokens can often be staked or used in other DeFi protocols for additional earnings. Liquidity offers financial rewards and enhances market depth and stability, benefiting the entire trading ecosystem.

- Lending in Pholend: Pholend is CrossFi’s lending and borrowing platform, where users can lend their XFI tokens to others or borrow XFI by providing collateral. Lenders earn interest on their XFI supply, generating passive income over time. Borrowers can access capital without selling their assets, which is helpful for leveraging positions or covering short-term expenses. Pholend utilizes smart contracts to automate loan agreements, ensuring transparency and security for all parties involved.

Investments in Other Crypto Assets

- Trading: Within the CrossFi ecosystem, XFI can be traded for other cryptocurrencies or digital assets. Users can leverage XFI to diversify their portfolios, speculate on market movements, or invest in new projects. Trading pairs involving XFI provide liquidity and easy access to tokens on CrossFi’s platforms, such as xSwap. This seamless trading experience allows users to manage their investments efficiently within a single ecosystem.

- Portfolio Diversification: Including XFI in a diversified crypto investment strategy helps spread risk and capitalize on different growth opportunities. As the native token of CrossFi, XFI is directly tied to the network’s performance and adoption. Holding XFI alongside other assets like Bitcoin, Ethereum, or stablecoins can balance a portfolio by combining the potential for high growth with assets with varying risk profiles. Diversification is a critical strategy in managing volatility and achieving long-term investment goals.

Payments and Transactions

- Fast Transfers: XFI enables quick and cost-effective transactions across the CrossFi network. Users can send and receive XFI with minimal fees and near-instant confirmation times, making it ideal for peer-to-peer payments, remittances, or settling transactions between businesses. The efficiency of XFI transactions reduces reliance on traditional banking systems, which often involve higher fees and longer processing times.

- Merchant Payments: As the CrossFi ecosystem expands, more merchants and service providers may start accepting XFI as a form of payment. This adoption allows users to purchase goods and services directly with XFI, fostering a decentralized economy. For merchants, accepting XFI can open up new customer bases and reduce transaction costs associated with credit card processing or currency conversion. Initiatives to integrate XFI payments into e-commerce platforms and point-of-sale systems are underway, promoting wider acceptance.

Governance and Voting

- Influence Network Decisions: XFI token holders have the power to shape the future of the CrossFi network through governance and voting. By participating in decentralized governance mechanisms, users can propose changes, vote on protocol upgrades, adjust fee structures, or influence the development of new features and services. This democratic approach ensures that the network evolves in a way that reflects the collective interests of its community members.

- Community Engagement: Active involvement in the CrossFi community goes beyond voting. XFI holders can engage in discussions on forums, contribute to development projects, or participate in community-led initiatives and events. By sharing ideas and collaborating with others, users help foster innovation and drive the ecosystem’s growth. This engagement strengthens the network and provides personal opportunities for learning and networking within the blockchain space.

Additional Considerations

- Earning Rewards Through Incentive Programs: CrossFi may offer incentive programs, such as yield farming or liquidity mining, where users can earn extra rewards by providing liquidity or participating in specific activities. These programs often provide higher returns for early adopters or those who contribute significantly to the network’s growth.

- Educational Opportunities: Using XFI within the CrossFi ecosystem, users can gain hands-on experience with DeFi applications, smart contracts, and blockchain technology. This practical knowledge can be valuable for personal development or professional opportunities in the rapidly growing blockchain industry.

- Security and Trust: Utilizing XFI within CrossFi’s platforms ensures users benefit from the network’s robust security measures, including smart contract audits and transparent operations. Engaging with official applications reduces the risks associated with scams or fraudulent projects shared in the crypto space.

In summary, XFI is a versatile tool within the CrossFi ecosystem, offering multiple avenues for financial growth, active participation, and community engagement. Whether through DeFi applications, trading, payments, or governance, XFI empowers users to leverage the CrossFi network’s capabilities fully.

Getting Started with XFI

- Set Up a Wallet

- Choose a Compatible Wallet: Select a wallet that supports XFI, such as the MetaMask or other compatible third-party wallets.

- Secure Your Wallet: Safeguard your private keys and enable security features like two-factor authentication.

- Acquire XFI

- From Exchanges: Purchase XFI on supported exchanges and transfer it to your wallet.

- Participate in Network Activities: Earn XFI through staking or participating in network programs.

- Engage with the Ecosystem

- Explore DeFi Platforms: Use XFI in various DeFi applications within CrossFi, such as staking, lending, or liquidity provision.

- Participate in Governance: Use your XFI holdings to vote on proposals and contribute to the network’s future.

- Stay Informed

Read Documentation: Familiarize yourself with the CrossFi Docs for detailed information.

XFI’s Role in DeFi Protocols

xApp: An aggregator that provides users with access to all CrossFi services through a simple and intuitive interface.

xAssets: A protocol enabling the trading of tokenized real-world assets such as oil, gold, and stocks. XFI is used as a medium for these trades and to cover associated gas fees.

xSwap: CrossFi’s core decentralized exchange (DEX), where XFI plays a critical role as a trading pair and in liquidity mining.

Pholend: A lending and borrowing protocol where XFI serves as a key asset, allowing users to borrow or lend against their holdings.

XFI Growth Potential and Price Forecast

With the launch of the mainnet, XFI will become increasingly integral to the CrossFi ecosystem, influencing both its price and demand. Key factors driving the future value of XFI include:

- Native Utility for Transactions: Every transaction on the CrossFi network will require XFI, creating a constant demand for the token. As more decentralized applications are deployed, the need for XFI will grow, putting upward pressure on its price.

- Expanding DeFi Ecosystem: The launch of several DeFi protocols interacting with XFI will drive demand for the token. As these protocols gain traction and attract more users, the utility and market value of XFI are likely to increase.

- Broader Adoption and Partnerships: CrossFi’s strategic partnerships and cross-chain collaborations will help drive liquidity and user adoption, further boosting the demand for XFI.

Conclusion

The launch of the CrossFi Mainnet is a major event in the world of blockchain and decentralized finance. From day one, it will offer a secure, scalable platform with real-world asset interaction. With the integration of EVM, CrossFi is set to offer advanced DeFi tools, increased interoperability, and significant growth potential for developers and investors.

At the heart of this ecosystem is the XFI token, which plays a critical role in powering the network, from transaction fees to governance and DeFi participation. As the CrossFi ecosystem expands, XFI’s utility and value are poised to grow, making it an essential asset for anyone involved in the decentralized finance space.

Get involved today, and be part of the future of decentralized finance with CrossFi!

FAQs

1. What is the significance of the CrossFi Mainnet launch?

The CrossFi Mainnet launch on October 15, 2024, marks the transition to a fully operational blockchain ecosystem, where users can interact with real assets in a decentralized environment. It unlocks full capabilities for staking, liquidity provision, and DeFi protocols using the XFI token.

2. How does the integration of the Ethereum Virtual Machine (EVM) benefit CrossFi?

The integration of EVM allows CrossFi to support advanced decentralized financial tools like decentralized exchanges (DEXs), smart contracts, and yield farming strategies. It also promotes cross-chain interoperability, allowing developers to port applications from Ethereum to CrossFi easily.

3. What role does the XFI token play in the CrossFi ecosystem?

XFI is the native token for the CrossFi blockchain. It is used for transaction fees, staking, governance, and collateralization to mint xUSD, CrossFi’s stablecoin. XFI holders can also participate in DeFi protocols within the CrossFi ecosystem.

4. How can users obtain XFI tokens?

Users can obtain XFI by purchasing it on supported cryptocurrency exchanges like MEXC and Uniswap, staking their holdings to earn rewards, or participating in CrossFi’s incentive programs, including airdrops and liquidity mining.

5. What applications will be available on CrossFi Mainnet at launch?

The CrossFi Mainnet will feature a range of decentralized applications (dApps) from day one, including staking platforms, liquidity mining, token swaps, and the issuance of synthetic assets. These applications provide users with opportunities to earn returns, trade, and engage in DeFi activities.

GET MPX

GET XFI

GET MPX

GET XFI

CrossFi Chain

CrossFi Chain

Cosmos

Cosmos

EVM

EVM

xApp

xApp

LP tokens

LP tokens

Swap

Swap

CrossFi Foundation

CrossFi Foundation

Users

Users

Creators

Creators

CrossFi Evolution Hackathon

CrossFi Evolution Hackathon

Developers

Developers

Validators

Validators